Service

Service

International Taxation

International Taxation

Coping with our clients’ international taxation issues, we have alliance firms in Hong Kong, China, Thailand, Vietnam, Los Angels, as well as other countries, and our foreign consultants with their expertise are able to deal with up-to-date international taxation issues.

Consulting on international taxation

The main international taxation issues are bilateral tax agreement, transfer price taxation, anti-tax haven taxation, thin capitalization taxation, foreign tax credit system, and salaries for expatriate employees. Dealing with these issues, it is necessary to be familiar with special knowledge, as well as the latest information relevant to each country/region.

We have business alliance with firms overseas, and our foreign specialists are able to promptly respond to your every need.

Consulting on transfer pricing

As a company becomes globalized, the number of transactions with overseas subsidiaries and overseas corporate partners would increase. ?However, taxation authorities in various countries try to secure their income sources by setting various regulations on the transactions with oversea subsidiaries in order to avoid unreasonable decrease in their tax revenue and secure their income sources. For example, if a Japanese company records purchases from overseas subsidiaries at an unreasonably high price, this means that the income of the Japanese company is transferred overseas; in such a case, the Japanese tax authority will not justify the portion of the price that the authority determines as unreasonable upon taxation.

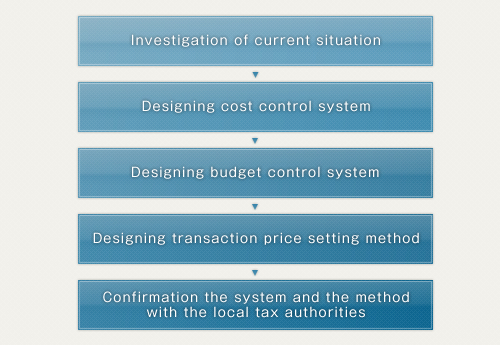

To assist our clients to solve transfer pricing issues, we provide our services in the following phases,

Financial review services on overseas subsidiaries

We assist to review global business strategies through evaluating tax risks including reviewing account settlement of overseas subsidiaries, and communicating with local tax authorities. ?Also, through investigating the accounting and tax treatments of the local subsidiaries, we provide advices for our clients to be able to accurately understand consolidated adjusting treatments in compliance with “Practical Solution on Unification of Accounting Policies Applied to Foreign Subsidiaries for Consolidated Financial Statements (Practical Issues Task Force No. 18).”